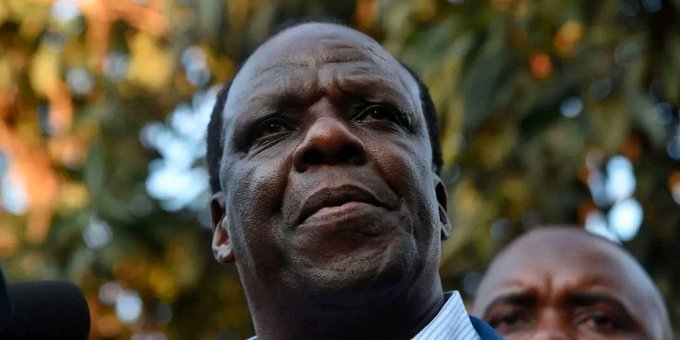

Cooperatives and Micro, Small, and Medium Enterprises (MSMEs) Development Cabinet Secretary (CS) Wycliffe Oparanya has decried poor management practices in the majority of savings and credit cooperatives (saccos).

Oparanya said high levels of mismanagement is threatening the existence of some saccos.

“I have been in office for only three weeks but one thing has become clear; the major problem facing our saccos is poor governance. There is a lot of mismanagement in our saccos,” he regretted.

Speaking at St Michaels Primary in Nairobi during a meeting of LOMPASAGO Sacco, the CS said it is the responsibility of sacco boards to ensure members’ contributions are safe.

“Most boards overstay. You will find that in some saccos, the board chairs have been in office for over 30 years. They just keep winning elections. Why can’t one do six years and let someone else also run the sacco,” he stated.

The CS further said sacco members are also to blame for the woes facing the sector.

“Members demand dividends even when their sacco is making losses. This forces some saccos to pay dividends from the capital. Some members demand that dividends match those of rival saccos. If the rival declared dividends of 12 per cent, they also insist on the same and end up contributing to the mismanagement,” he explained.

Present at LOMPASAGO’s members education day and Special AGM were Nairobi County Chief Officer in charge of cooperatives George Mutiso and Nairobi County Executive Anastasia Nyalita (Cooperatives)

LOMPASAGO was registered on June 20, 1980, by the Commissioner of Co-operative Development, under Co-operative Society’s Act Cap 490 section 7 of the laws of Kenya.

The Sacco’s main aim is to promote members’ economic interests through the mobilisation of deposits, savings, and investments.

Membership currently stands at 3,800 members drawn from 150 companies.

Lompasago Board chairman Bernard Ngunjiri while noting that the sacco’s asset base is Sh600 million said the number of active members currently stands at 4,335.

He said the sacco aims to double the asset base in two years.

“We want to recruit new members which will translate to more revenues for the sacco. We have organised roadshows targeting particular sectors of the economy,” he stated.

“We are competing with financial institutions like banks which have muscle but our market share is there if we invest properly in service delivery.”